Tax evasion involves avoiding paying taxes, which is an obligation established by law.

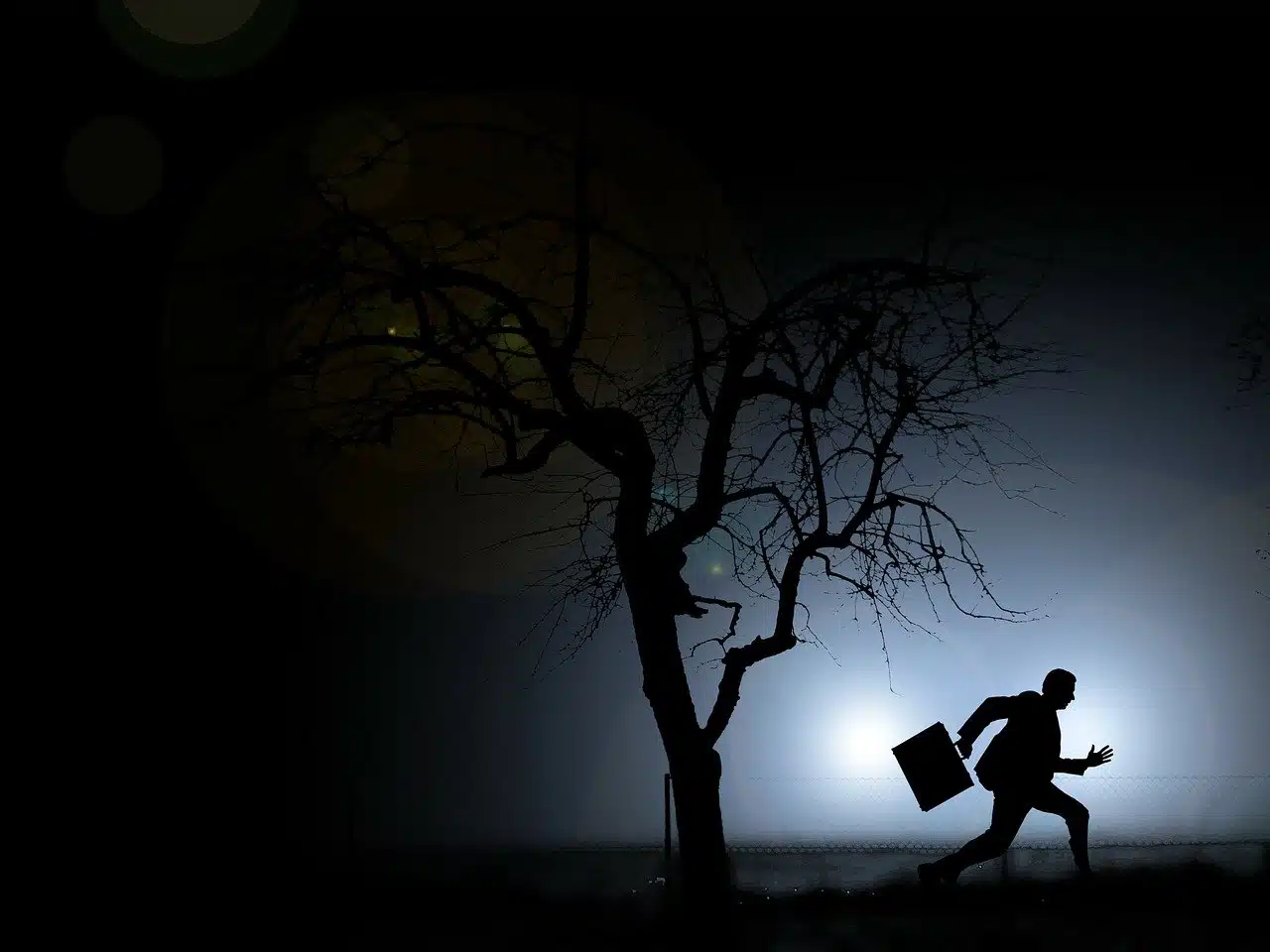

Tax evasion is the action of avoiding paying taxes established by law . It is a legal figure that involves a voluntary act of non-payment that is punishable by law because it is a crime or an administrative infraction .

From the Latin evasĭo , evasion is the action and effect of evading or evading . This verb can refer to fleeing, avoiding danger, evading a difficulty or removing money or goods from a country illegally.

Fiscal , on the other hand, is an adjective that is linked to what belongs to or relates to the treasury (the set of public bodies that are dedicated to collecting taxes). The treasury is also the public treasury in general. Specifically, we can determine that fiscal is a word that also comes from Latin. What's more, it emanates from the term fiscus , which can be translated as "public treasury or basket."

Characteristics of tax evasion

Also known as tax evasion or tax evasion , tax evasion involves the creation of black money (wealth obtained through illegal activities or through legal activities not declared to the treasury). Such money is generally kept in cash since, if it is deposited in a bank, it is registered and the State may be aware of its existence.

In addition to all this that we have explained, it is important to know that, in order to speak of a case of tax evasion, several elements must take center stage. Specifically, there must be a subject who is obliged to make the relevant payment, there must be a breach of the existing law and also the tax in question must not be paid.

Tax evasion is a crime.

The avoidance

The figure that consists of not paying certain taxes under the protection of a legal loophole is known as tax avoidance . Avoidance takes advantage of deficiencies in the wording of the law and is different from tax evasion since it does not violate the legislation, but rather uses technicalities and tricks within the legal framework.

This type of evasion action is closely related to the existence of what are known as tax havens , which are those countries that allow foreign investors not to have to pay taxes. In this way, it is made easier for a multitude of people from outside to decide not only to reside in them but also to take money to their banks.

Currently, Switzerland is among the main tax havens. Some time ago, in Spain, numerous accounts were discovered opened in Swiss financial institutions by powerful Spanish citizens who thus did not pay the taxes required of them in their country.

Examples of tax evasion

There are various examples of what tax evasion can be. Thus, among the most frequent modalities are the acquisition of subsidies absolutely without any justification, the concealment of income and also the illicit increase of what are deductible expenses.

Fiscal disobedience , fiscal resistance or fiscal objection , finally, consists of refusing to pay a tax due to a disagreement with the collecting institution.