The idea of a credit note is used in the field of accounting . This is a document that can be used to cancel an invoice or to offset any amount included in it .

The idea of a credit note is used in the field of accounting . This is a document that can be used to cancel an invoice or to offset any amount included in it .

When a commercial transaction is completed, the seller issues an invoice corresponding to the product delivered or the service provided. It details the money that the buyer/user had or has to pay. If, for any reason, the invoice must be canceled or a percentage of what was paid must be returned, the credit note is used.

It can be said, therefore, that the credit note is a receipt generated by the same company or the same person who issued the invoice in question. Through the credit note , precisely, the return of a certain value is accredited for a concept that is detailed in the document itself .

The importance of credit notes lies in the legal impossibility of eliminating an invoice that has already been issued. Whoever needs to correct an invoice or cancel it, in this framework, must resort to a credit note.

Suppose that a satellite television company sends a customer an invoice for a total of 2,000 pesos , of which 1,500 pesos correspond to the basic service and 500 pesos to a premium channel package. Said client, however, never subscribed to those premium channels or enjoyed their signals. Upon complaint, the company issues a credit note for 500 pesos . Thus, the subscriber will be able to deduct those 500 pesos from the credit note when making the next payment .

On the other hand, there is the concept of a debit note , a receipt that companies send to their clients to notify them that they have charged or debited a particular value or sum in their accounts. In this case it is also necessary to indicate the concept of the operation in the document itself. Unlike the credit note, the debit note serves to record an increase in the client's debt .

Many confuse this concept with that of a credit note , since both are receipts or documents that companies prepare to make certain adjustments to third-party accounts, either because they have made an error or because the client has been late in paying their bills. debts or because a change in conditions has occurred that results in an increase or decrease in the value of the account in question.

Many confuse this concept with that of a credit note , since both are receipts or documents that companies prepare to make certain adjustments to third-party accounts, either because they have made an error or because the client has been late in paying their bills. debts or because a change in conditions has occurred that results in an increase or decrease in the value of the account in question.

Let's see below a list of very specific reasons why a company may need to prepare a credit note:

* if you wish to give the customer a particular discount that was not specified in the invoice issued to you when you made your purchase of products or services;

* Correct any errors you may have made on the first invoice. The most common example is that the price of one or more products or services has not been correctly reflected on the invoice, but rather a lower price has been indicated;

* if the customer wishes to make use of their right to return a product because they received it damaged or for other reasons contemplated by the company's regulations;

* to cancel an operation or give the client a bonus.

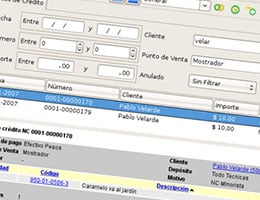

When making the credit note, it is very important to include the same information that appears on the invoice that you wish to complement. Regarding the format, the freedom is the same as the present with invoices, that is, they can be issued on paper or electronically. Currently, most companies opt for electronic issuance to avoid the need to digitize notes and improve control through an accounting program.