An accounting entry allows the recording of an economic or commercial movement that modifies the assets of an entity.

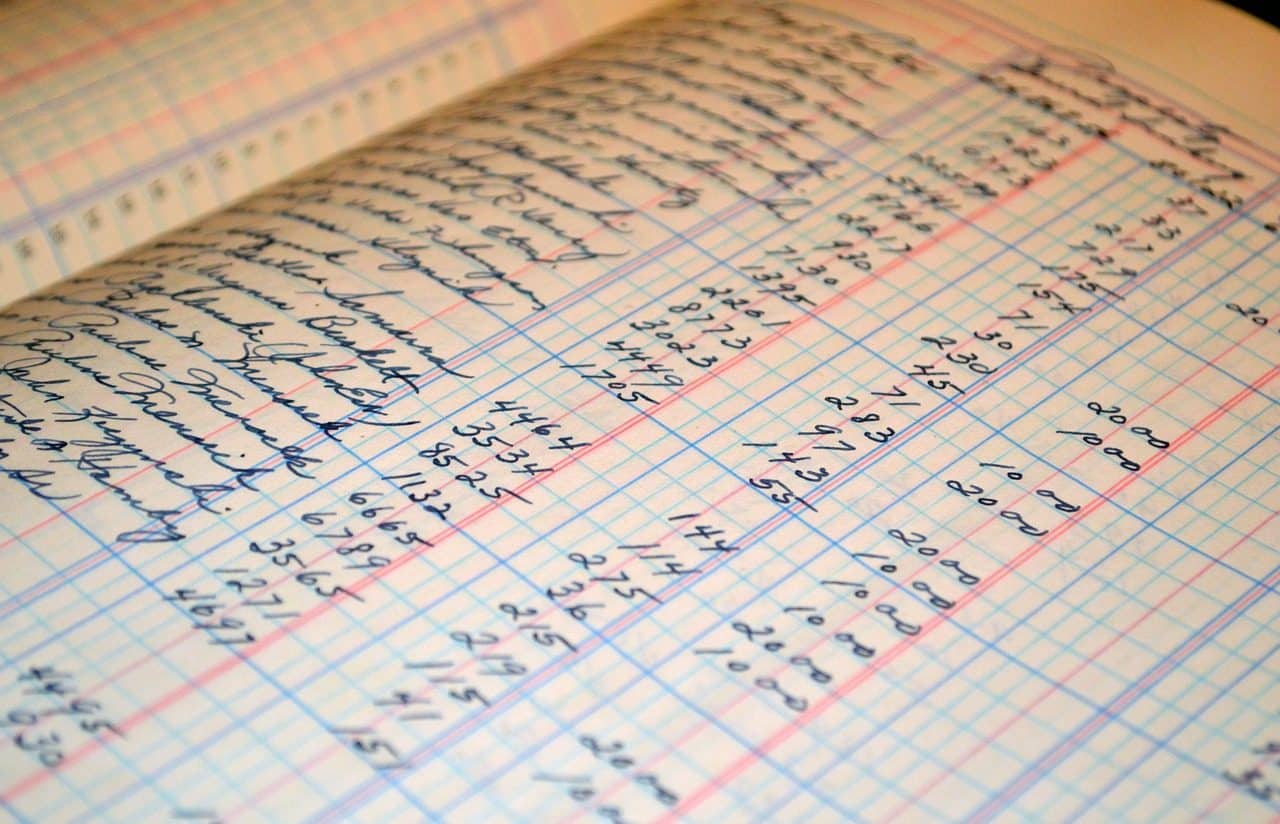

An accounting entry is the entry made in an Accounting book that allows recording a commercial or economic movement that changes the assets of an organization. This modification of the entity's capital can be positive or negative, according to the characteristics of the entry.

It should be noted that the notion of seat has various meanings. The term is generally associated with furniture that allows you to sit , being used as a synonym for bench , chair or armchair . The concept, in any case, comes from the verb asentar (to sit, place something firmly, record).

Accountable , for its part, is an adjective that mentions what is linked to accounting (the discipline that makes it possible to keep accounts or the aptitude related to the ability to process things as calculations).

Registration of an accounting entry

Typically, the system for recording accounting entries is developed in a double structure so that movements are recorded in Assets and Liabilities .

The Asset records the income or credits for the entity, while the Liability records the payments, outflows of money and debts. The logic of the double system is that every movement influences at least two accounts (if it increases the asset it reduces the liability and vice versa).

Classification according to type

When the entry affects a single Asset account and a single Liability account, it is called a simple entry . If, however, the movement influences other additional records, it is classified as a compound entry .

It should be noted that accounting entries can contain different data. The amount of the movement is essential, although the date, which account it affects, and a description that summarizes the characteristics of the activity are also usually recorded.

An accounting entry can be simple or compound.

How to avoid errors with accounting entries

Through accounting, we can use a different criteria and set of rules for each set of accounts. For this reason, it is essential to establish certain guidelines in order to achieve the best results, and in this context there are several tips that experts give us to avoid many of the most common mistakes.

The first tip to correctly make accounting entries is to maintain order and control over income and expenses. The former originate from sales , while the latter, from purchases, rental of premises or supplies, financial expenses and payments to employees , among others. It should be noted that both groups sign up almost every day in most companies.

To minimize the possibility of errors in the records of accounting entries, it is recommended to correctly organize the receipts and invoices as soon as they are issued. A very common custom in small companies is to leave these issues for the last day, in which it will be necessary to navigate through a stack of papers and capture their values on a spreadsheet, something that would be the nightmare of any accountant. You cannot properly control the flow of resources if there is no order from the beginning.

Pending payments and collections must also be managed responsibly. These must be noted twice, both when they are pending and when they become effective. Forecasting is also essential in these operations, since too many operations should not be accumulated, more than the company can afford.

The order seems to be the constant so that the accounting entries do not have errors and are easy to review. And this aspect must not only be applied to monetary operations, but must also arise from any action that may affect accounting throughout the entire period. For example, inventory must be kept up to date so that potential errors are caught in time.